by Mark J. Perry, AEI

Below are a few excerpts from some recent reports on NAFTA and Trump’s threat to pull out of what the protectionist-in-chief calls the “worst trade deal ever made.” From the Wall Street Journal’s editorial yesterday (“A NAFTA Recession?“), emphasis mine:

President Trump keeps touting the 3% U.S. GDP growth of the last two quarters and “record” stock prices, and the economy is his best talking point. But he might want to take a look at the latest Journal survey of economists about the impact of a U.S. withdrawal from the North American Free Trade Agreement.

Not a single economist said that the withdrawal Mr. Trump has threatened would help the economy. Some 82% said the economy would grow more slowly for the next two years than it would otherwise, and 7% predicted a recession. That underestimates the risks of recession in our view, given the political shock from such a reckless act by a U.S. President and the damage that would ensue to North American and even global supply chains.

Mr. Trump is doing well overall on economic policy, with deregulation and support for tax reform. But his Achilles’ heel is his protectionist trade agenda and his lack of knowledge about the international economy.

And this excerpt below is from Kevin Williamson’s cover story in the latest issue of National Review (“The Triumph of NAFTA: The Trade Pact is a Smashing Success — Why Does Everybody Hate It?“), subscription required (emphasis mine):

Trump has threatened to pull out of NAFTA if he does not get his way, a move that would be, in the estimate of the Wall Street Journal’s editorial page, the “worst economic blunder since Nixon.” The U.S. Chamber of Commerce shares this view, and hundreds of state and local Chamber affiliates signed a letter asking that Trump not inflict needless chaos on North American trade rules out of pure pique and malice and stupidity. (They did not put it quite like that.) The U.S. Automotive Policy Council is spooked by the prospect of losing NAFTA, a development that would constitute a “$10 billion tax on the auto industry in America.” The Boston Consulting Group says that losing NAFTA could cost 50,000 jobs in the auto-parts business alone, and American farmers do not want to see new tariffs on the $40 billion in farm produce they send to Canada and Mexico, two of our three largest export markets. In the years since NAFTA was enacted, U.S. manufacturing has grown, trade has grown, exports have grown, employment has grown, wages have grown, the services industry has absolutely boomed, and consumer prices for many North American–traded goods have gone down. Why mess with a good thing?

……

Criticisms of NAFTA tend to be either very vague or dramatically sweeping. But the economic data do not support the populist indictment of free trade and free-trade pacts. The overwhelming consensus among economists is that NAFTA has had a negligible to modestly positive impact on U.S. employment and wages, and a modest to substantial effect on GDP growth — adding as much as 0.5 percent annually by some estimates. It is true that manufacturing employment has declined in the NAFTA era. It was declining before that, too, beginning in the 1950s. As J. Bradford DeLong of Berkeley runs the numbers, the effect of free-trade pacts on manufacturing employment accounts for less than 5 percent of the job losses, and probably more like 1 percent. That “giant sucking sound” that H. Ross Perot so feared has not come to pass, and in certain high-paying industrial fields, such as automobile manufacturing, NAFTA has been a boon in unexpected ways: It is true that some manufacturing work has been outsourced to low-wage Mexico and to high-wage Canada, but access to an integrated North American supply chain and duty-free access to the three national markets are key parts of what brought the “transplants” — European and Asian automakers building in the United States with American labor — to places such as Texas and Alabama.

Prosperity always emerges in unexpected ways, and NAFTA is one way in which we get the bureaucrats and mandarins and central planners out of the way to let that happen.

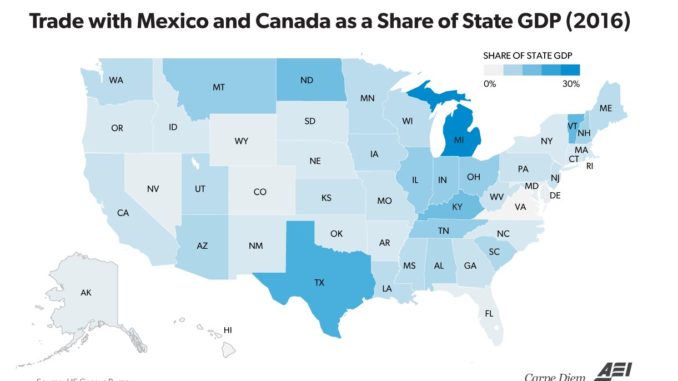

MP: The map and table above help tell the story of the economic importance of NAFTA, and trade with Mexico and Canada, to each US state’s economy. The table above shows the total merchandise trade for each US state with Canada and Mexico last year (exports + imports), both in total volume and as a percentage of each state’s GDP. The map above displays the trade with Mexico + Canada in 2016 as a percentage of each state’s GDP. Note that for automotive manufacturing-intense states like Michigan, trade with Mexico ($61 billion) and Canada ($71 billion) last year represented more than 25% of the state’s GDP of $487 billion. Other states with significant automotive production like Texas, Kentucky, Indiana, Tennessee, Ohio, Alabama and South Carolina had trade with Canada and Mexico last year that represented more than 5% of state GDP. For border states like Texas, North Dakota, and Vermont, trade with NAFTA partners represented more than 10% of the state’s economic output in 2016. In total, merchandise trade with Mexico and Canada (exports + imports) last year totaled more than $1 trillion and represented nearly 6% of US GDP.

As the WSJ pointed out, Trump’s Achilles’ heel is his protectionist trade agenda and his lack of knowledge about the international economy. Part of that lack of knowledge about the international economy is Trump’s failure to appreciate how important NAFTA trade is for American workers and consumers. Kevin Williamson correctly assesses NAFTA as a “triumph” and a “smashing success.” The data support that assessment. Let’s hope the protectionist-in-chief reviews the economic data and hope that his Achilles’ heel for protectionism doesn’t result in scrapping a very successful economic trade deal that has generated significant economic benefits for the workers, consumers, and companies in all three countries.