by Peterson Foundation

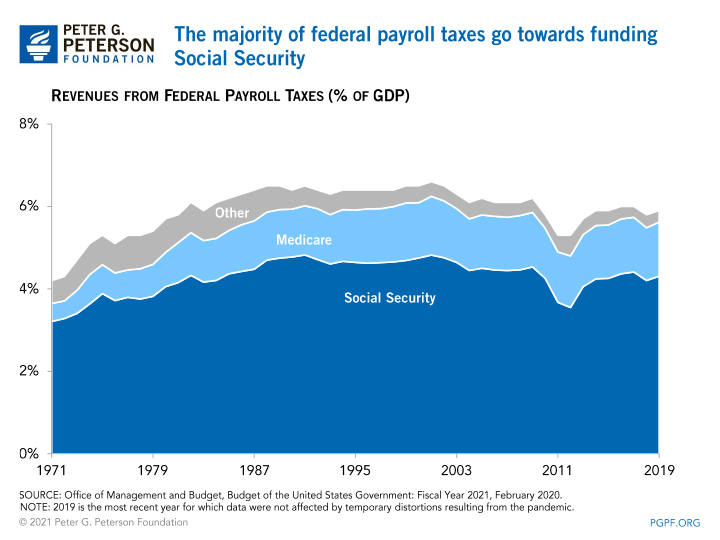

More than 35 percent of taxes collected by the federal government take the form of payroll taxes, which fund social insurance programs. Most working Americans are subject to payroll taxes, which are usually deducted automatically from an employee’s paycheck. Employers are also often subject to these types of taxes.

The vast majority of federal payroll taxes go towards funding Social Security and Medicare:

- Taxes directed to the Social Security program were created by the Federal Insurance Contributions Act (FICA) and are levied equally on employers and employees on all incomes up to a certain level.

- Medicare taxes for its Hospital Insurance (HI) program were also part of FICA and are levied equally on employers and employees on all income. In addition, the Medicare trust fund also receives inflows from a supplemental tax on high earners.

A few other types of federal payroll taxes also fund smaller programs:

- Employers pay taxes to fund the Unemployment Insurance program.

- Programs to fund retirement for federal employees and railroad workers also receive payroll taxes.

What Is the Social Security Payroll Tax?

The portion of FICA taxes that is dedicated to Social Security is used to fund the Old-Age, Survivors, and Disability Insurance programs, which provide income on a monthly basis to retirees, the disabled, and their families. This is the primary source of funding for the programs, accounting for 88 percent of all inflows into their trust funds in 2018.

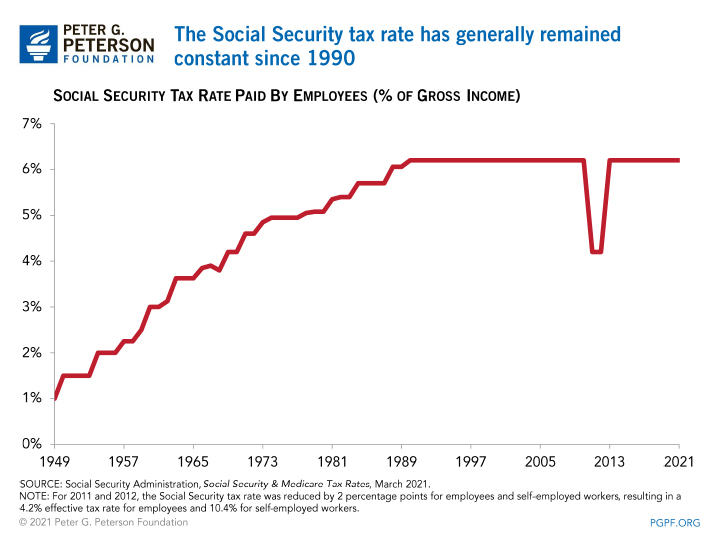

Employers and employees each pay 7.65 percent of payroll in FICA taxes; the portion dedicated to Social Security accounts for 6.2 percent of that total and is only levied up to a maximum amount determined annually (the remaining 1.45 percent is designated for Medicare). The tax rate for Social Security was originally set in 1937 at 1 percent of taxable earnings and increased gradually over time; the current rate has remained unchanged since 1990.

Self-employed individuals also contribute to these funds through Self-Employment Contributions Act (SECA) taxes. The rates for SECA taxes are identical to those for FICA taxes, with the only difference being that the individual is responsible for paying both employee and employer portions of the tax.

In 2018, Social Security received $855 billion in revenues from payroll taxes, or about 4.2 percent of GDP. The remainder of the program’s inflows come from taxation on Social Security benefits as well as interest on the balances of the trust funds.

What Is the Limit on Earnings Subject to the Social Security Payroll Tax?

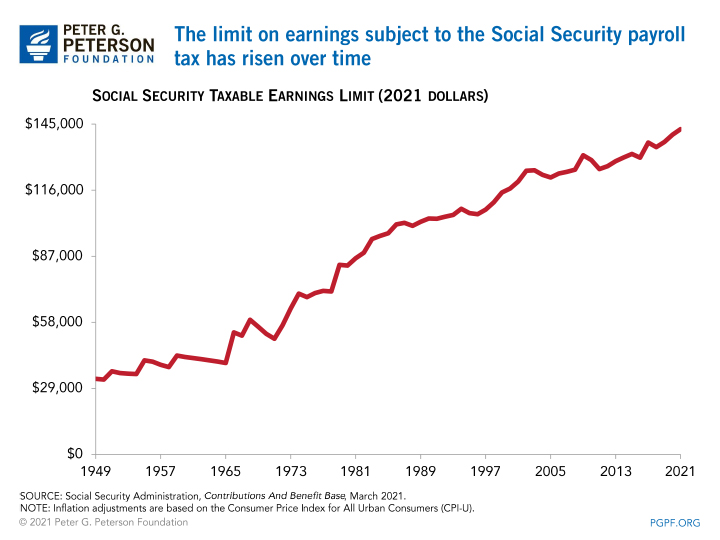

The Social Security payroll tax only applies up to a certain amount of a worker’s annual earnings; that limit is often referred to as the taxable maximum or the Social Security tax cap. For 2019, that maximum is set at $132,900, an increase of $4,500 from last year.

When the tax dedicated to Social Security was first implemented, it was capped by statute at the first $3,000 of earnings (which would be equivalent to about $45,000 in 2019 dollars). Since 1982, the taxable maximum has been adjusted annually based on the increase in an index based on the national average wage. Each year, about 6 percent of the working population earns more than the taxable maximum.

.

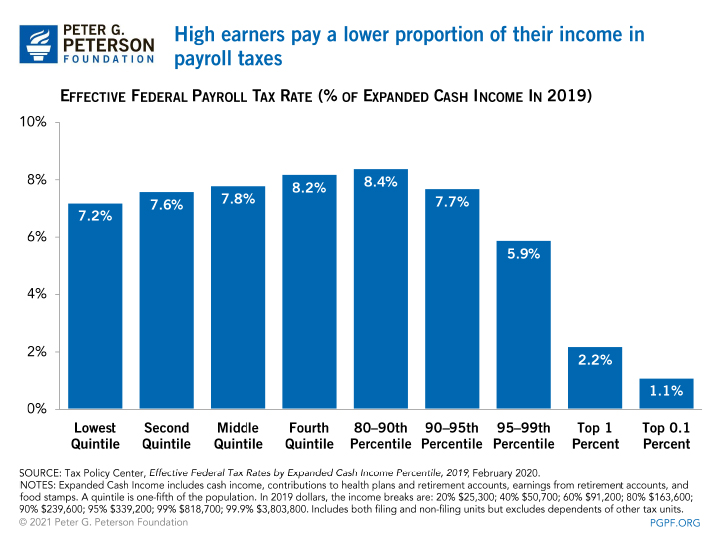

Economists consider the Social Security tax to be regressive, because as an individual’s earnings increase above the cap, the portion of total income that is taxed decreases.

Arguments For and Against the Social Security Tax Cap

Proponents of increasing or eliminating the limit on earnings subject to the Social Security payroll tax argue that it would make the tax less regressive and be part of a solution to strengthen the Social Security trust funds. An analysis from the Congressional Budget Office estimated that phasing out the tax cap could boost revenues by up to $1.2 trillion over the next decade. Another argument is that removing the taxable maximum would adjust for the fact that higher-income individuals generally have longer life expectancies, and thus receive Social Security benefits for a greater amount of time.

Opponents argue that increasing or removing the taxable maximum would weaken the link between the amount individuals pay in Social Security taxes and the amount they receive in retirement benefits. Opponents also contend that while low-income earners may pay a greater share of their income in Social Security payroll taxes than do those who are wealthier, they also receive a disproportionate share of government transfer payments that are not subject to the tax. These opponents cite programs that have been created to — at least partially — offset the regressive nature of the Social Security payroll tax.

Some economists anticipate that if the limit were lifted, employers might respond by shifting taxable compensation to a form of compensation that is taxed at a lower rate. For example, employers could decrease wages but increase retirement benefits, which are deductible under the corporate income tax, in an effort to offset the additional payroll taxes they would owe.

What is the Medicare Payroll Tax?

Employees and employers each contribute 1.45 percent of earnings by workers to Medicare, which is levied on all income. Since 2013, an additional 0.9 percent tax has been imposed on employees with income exceeding a threshold between $125,000 and $250,000 depending on filing status — these additional taxes are not matched by the employer.

The revenues from these taxes help fund Medicare’s HI program, which is used to pay for hospital stays and a few forms of home healthcare, such as hospice care. For 2018, HI tax revenues were about 1.3 percent of GDP, an amount that has been relatively constant for the past 25 years. The HI tax was originally the primary source of revenue for Medicare before the program grew to include Medicare Advantage Plans and prescription drug coverage. The taxes dedicated to HI now makes up 36 percent of Medicare’s total inflows, a share that is projected to decrease going forward.

Are there Other Federal Payroll Taxes?

In addition to FICA or SECA taxes, a few other payroll taxes are levied on certain employees:

- Federal Unemployment Tax Act (FUTA) taxes: These taxes are only paid by employers, at a rate of 6 percent for the first $7,000 of earned income per employee. FUTA taxes support funding for state-administered unemployment insurance programs.

- Railroad Retirement Act taxes: These taxes are paid by railroad employees and employers to fund retirement programs for railroad workers.

- Other payroll taxes are mostly comprised of taxes paid by federal employees to fund their own retirement programs.

How Do Payroll Taxes Work in Other Countries?

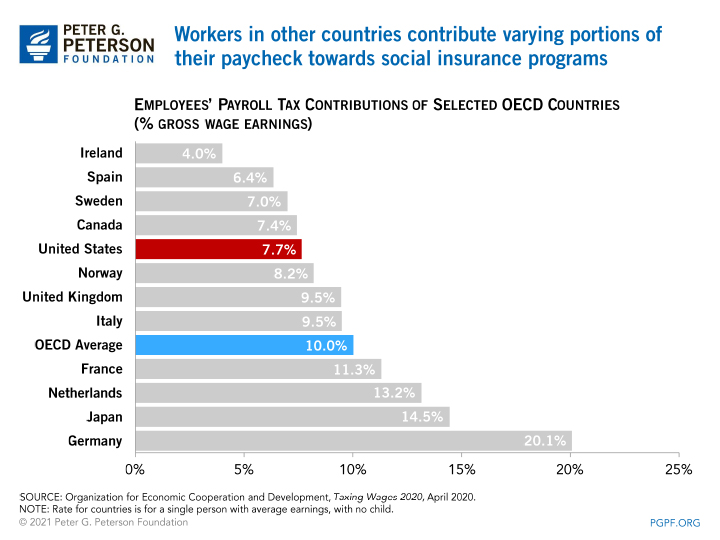

Many countries in the Organisation for Economic Co-operation and Development (OECD), a group of nations with high-income economies, also fund their social insurance programs with payroll taxes. While the Social Security systems of other countries take different forms, most provide a government-financed pension that provides income assistance for retirees, similar to that of the United States.

Despite this similarity, there is much variation in how other OECD countries impose payroll taxes on their citizens. Some countries, such as the Netherlands, Sweden, Germany, and Canada, have caps on taxable earnings that are lower than in the United States; others, such as Norway and Ireland, tax all earnings. Generally, countries with higher payroll tax rates have lower caps, while countries with lower payroll tax rates, like the United States, tend to have higher caps or no caps at all. And in some OECD countries, social insurance programs are funded through other sources such as income taxes or excise taxes.

Certain countries, like the United Kingdom and Austria, have a bracketed payroll tax structure that levies the payroll tax at different rates depending on total income, similar to how the United States levies income tax. In the United Kingdom this bracketed system is regressive in structure, while in Austria it is progressive.

Conclusion

Payroll taxes are an important component of America’s system of taxation and they fill an essential role in keeping social insurance programs funded and operational. Payroll taxes represent the second-largest source of federal revenues, after income taxes. On the household level, payroll taxes are often the primary federal tax an individual will incur; in fact, two-thirds of households are expected to pay more in payroll taxes than income taxes, according to the Urban Institute.

Social insurance programs, primarily Social Security and Medicare, face serious financial challenges. Understanding how these programs are funded through payroll taxes is important for developing reforms that will ensure that these programs can continue to provide benefits to those who depend on them.